If you have read our previous post on “The Path to FIRE : Who are we and Why now?” , you might be wondering how we are going to achieve Financial Independence. Below, we give an outline of our approach, our thought process, and our steps. But first…

DISCLAIMERS

Creating a financial model for your life is not easy, and it differs person to person. I am not a certified financial consultant, so please look at the information here as purely just educational content of what might work for me, and tweak it accordingly to your own needs.

OVERARCHING FRAMEWORK

A full fledged financial independence model would be too detailed for me to articulate every single consideration and aspect here, so what I am sharing is rather, a bird’s eye view of our current approach.

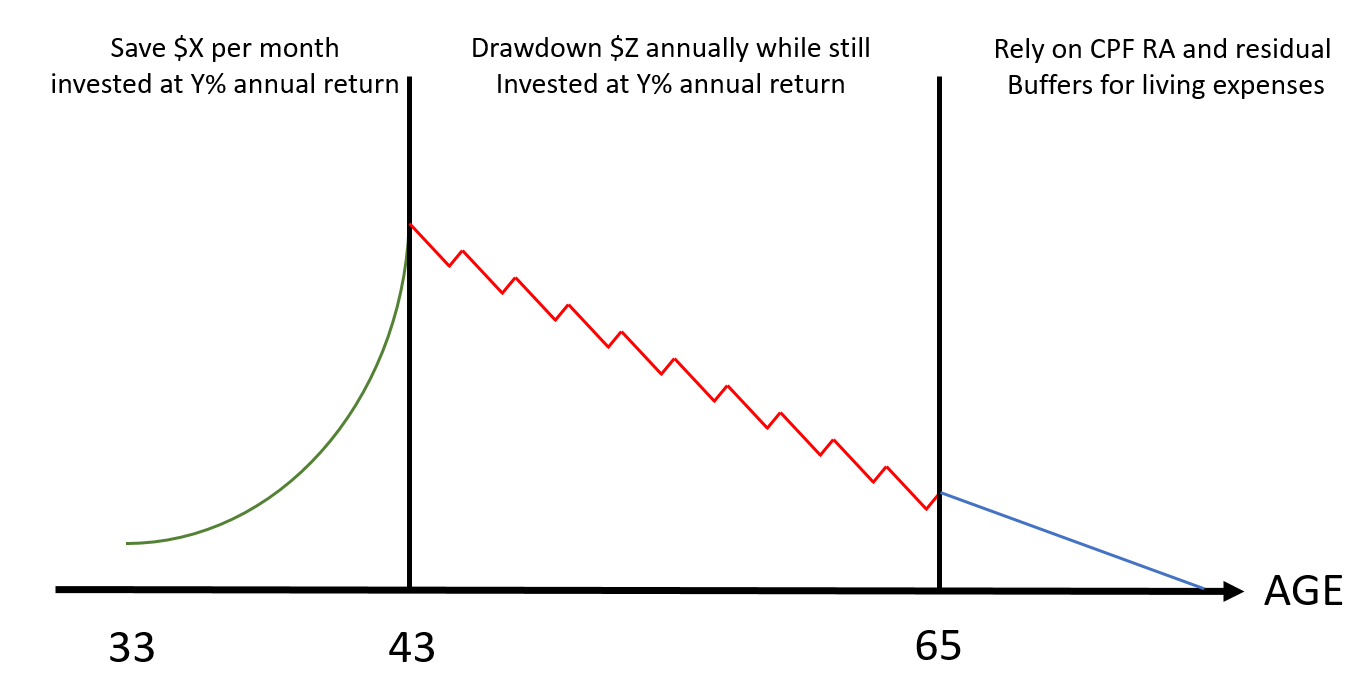

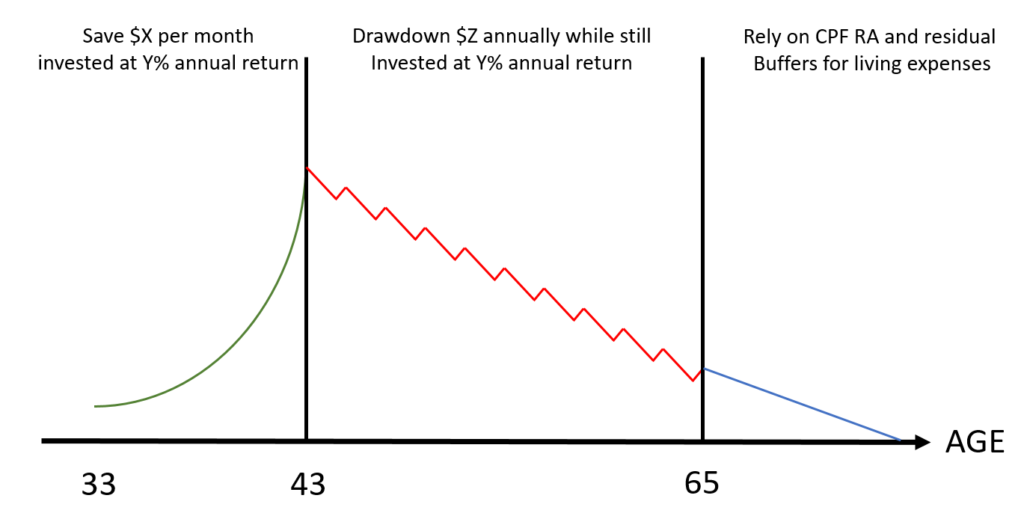

This is the plan for now :

- From the age of 33 to 43 – Work & save $X monthly to be invested at Y% return per year to create a nest egg

- From the age of 43 to 65 – Leverage the nest egg to draw down a fixed yearly amount $Z while still generating Y% returns through the years

- From the age of 65 onwards – Rely on CPF RA drawdown for living expenses

ASSUMPTIONS & ADOPTING A CONSERVATIVE APPROACH

I am someone that you would probably categorize as “risk-averse” when it comes to life decisions (I`m a different degen with Crypto but that’s a story for another day). So even if the math works out on the plan I articulated above, it wouldn’t cut it for me if it was going down to the penny. I need that margin of safety for a peace of mind, knowing that what I projected is a conservative approach that assumes no further upside to be captured.

Some assumptions :

- Pretend that I`m starting from 0 in accumulating this nest egg today (even though I have some savings to act as a buffer for emergency expenses)

- No increase in annual income over the next 10 years (I am quite stable at my job and this is unlikely)

- No decrease in annual fixed expenses that would not be needed (eg. Taxes if no longer working etc.)

- Did not include any potential income from side-hustles (we are aiming for a hybrid between BaristaFire and CoastFire)

- The amount saved each year is only invested in the following year (for simplicity sake)

These are the ones for a start and we would revise them along the way to incorporate new information as and when it becomes necessary.

SO WHAT WOULD BE $X, Y%, $Z TO GET TO FINANCIAL INDEPENDENCE?

This is the million dollar question – and it’s not a one-size fits all type of approach. If you think about it :

- $X saved per month is going to depend on your current income

- Y% of annual return is going to depend on how financial savvy you are with cash management and investments

- $Z of annual drawdown depends on your liabilities and lifestyle

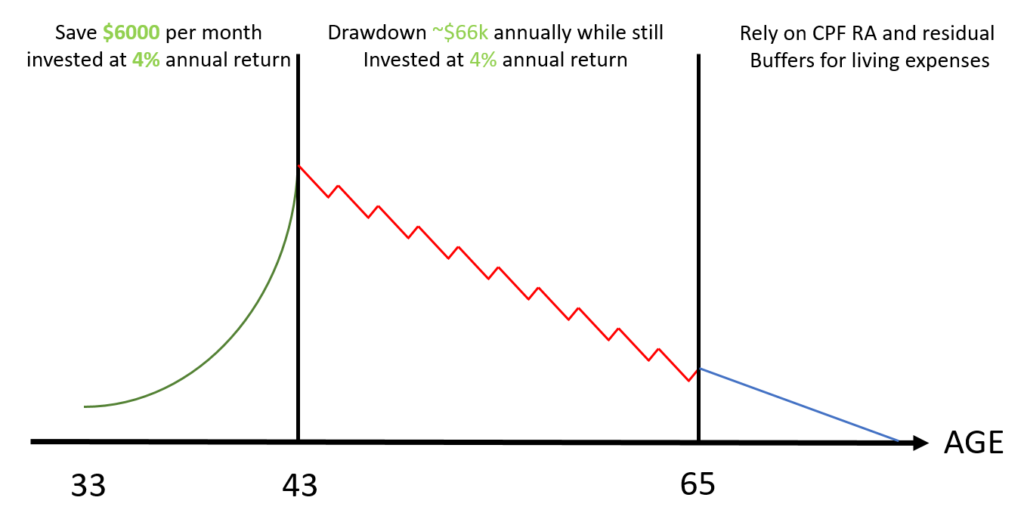

So what are my numbers looking like as of today?

$X = $6000 saved per month

Y% = 4% return per year

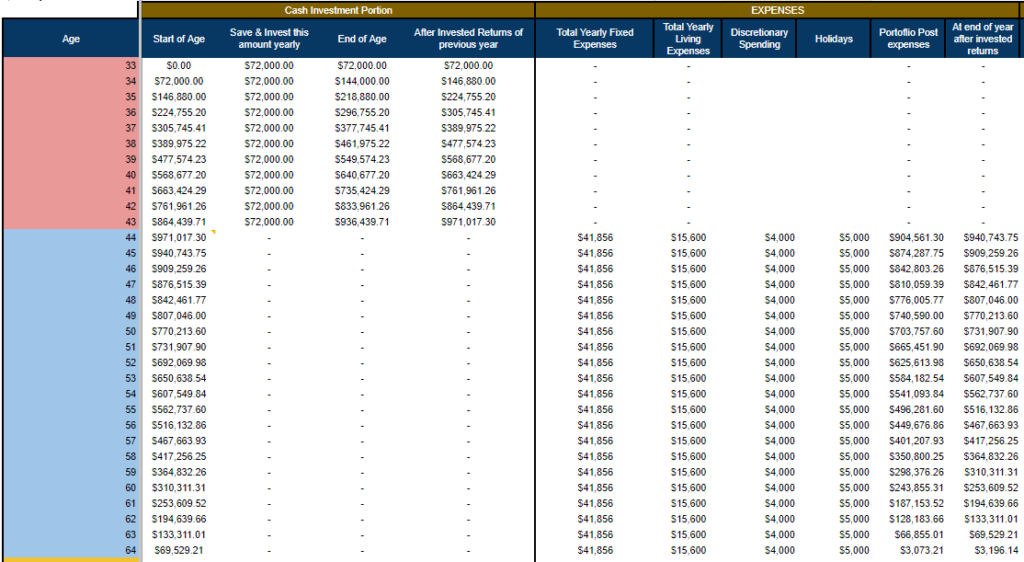

$Z = ~$42000 of fixed liabilities, $15600 of annual living expenses, $5000 for a holiday each year, and $4000 for discretionary spending

For me, I am currently drawing an annual salary close to ~$180k, which translates to approximately $14k per month after CPF deductions. Saving $6000 per month is not easy as I also have my liabilities, but it is a commitment I have begun since the start of 2023 in pursuit of Financial Freedom.

If you would like to know more about how I am trying to generate the 4% annual return, feel free to read this following article “”.

As for my $Z amount – it is something that is constantly changing so I would touch on those in a future post to elaborate on how we can conservatively estimate the costs that we need for a quality life post Financial Independence.

This is just an illustration of what is applicable to me at the moment, and your situation could be very different, depending on how much you are making, what kind of returns you can generate, and your future expenses.

SO HOW DOES THIS LOOK LIKE?

Graphically, this is how it looks like :

The actual raw data in tabular form would play out like this

This is of course subject to change but it is a framework I am working with. This table only captures a small portion of the overall plan, but to keep it simple for a start, this is what the overall idea is.

What do you think about this plan? Leave your thoughts or questions in the comments below!

Otherwise, if you are thinking how we would generate 4% returns on an annual basis, read the following article : “”